Irs Employee Business Expenses 2025. Section references are to the internal revenue code unless otherwise noted. Just to be clear, from 2018 through 2025, all employee moving expenses paid to employees by your business are taxable to the employee.

(form 2106) solved•by turbotax•2301•updated january 10, 2024. This rule basically allows employers to shift the 50% disallowance to employees.

Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Thus, with respect to employee business expenses, a deduction under sec.

This Article Will Walk You Through The.

You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year, for carrying on your trade or business of being an employee, and ordinary.

(Form 2106) Solved•By Turbotax•2301•Updated January 10, 2024.

Images References :

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

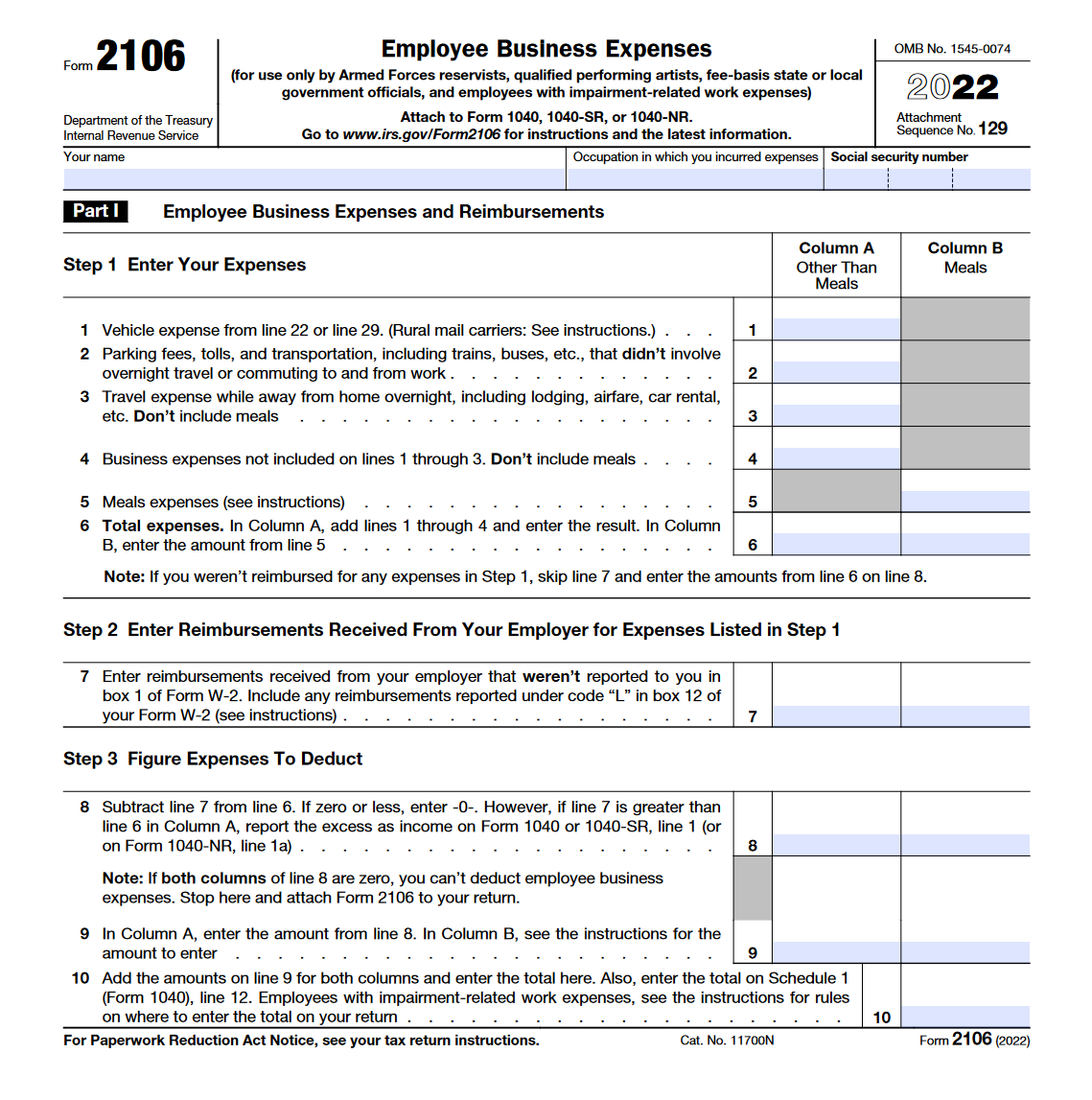

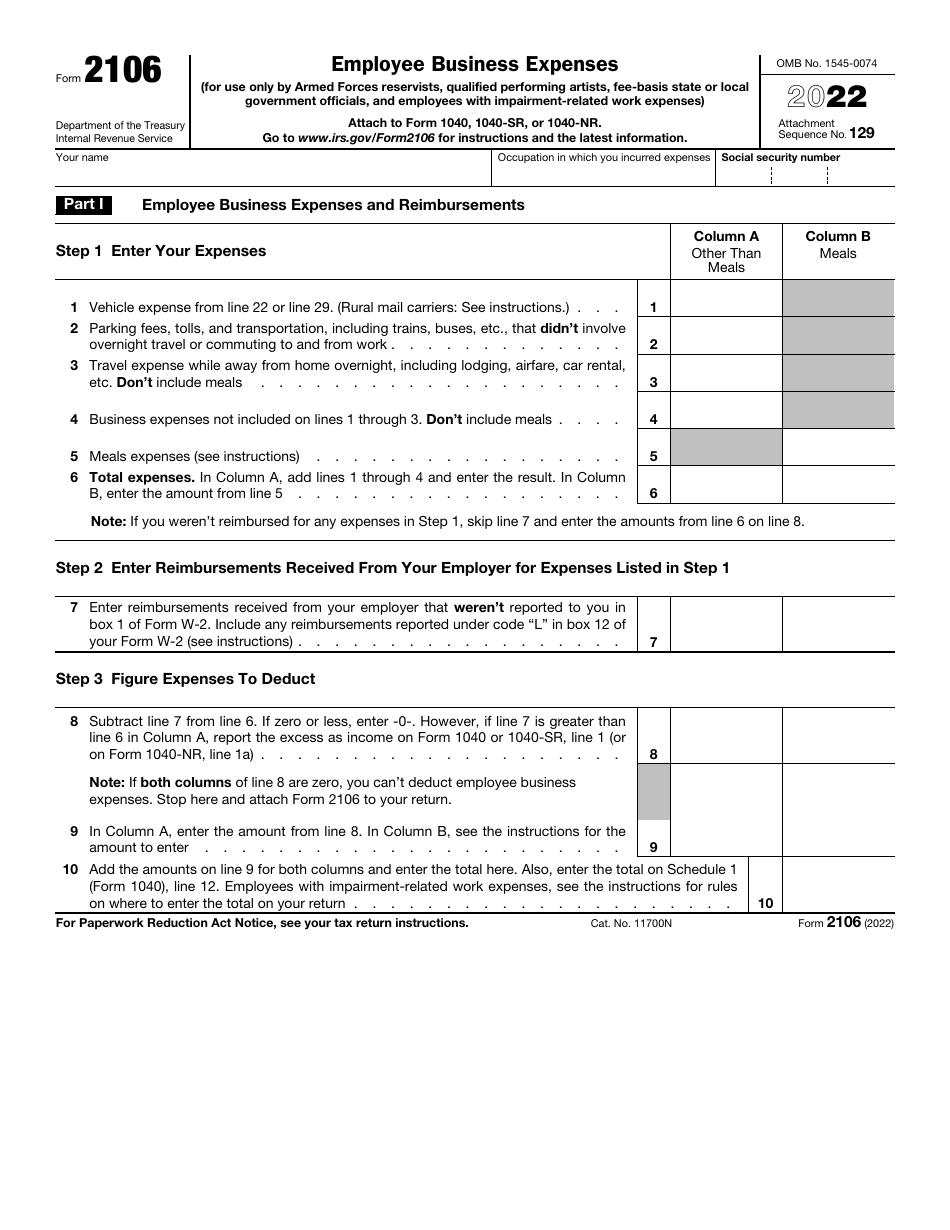

IRS Form 2106 A Guide to Employee Business Expenses, The tcja eliminates the deduction for unreimbursed employee business expenses for tax years 2018 through 2025. Too many small business owners get so excited about running the business.

Source: blanker.org

Source: blanker.org

IRS Form 2106. Employee Business Expenses Forms Docs 2023, Unreimbursed employee business expenses was a tax form issued by the internal revenue service (irs) for use by employees who wished to. Under the tax cuts and jobs act, employees can’t deduct their unreimbursed travel expenses through 2025 on their own tax returns.

![IRS Business Expense Categories List [+Free Worksheet]](https://fitsmallbusiness.com/wp-content/uploads/2023/05/Thumbnail_IRS_Business_Expense_Categories_2023-730x508.jpg) Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

IRS Business Expense Categories List [+Free Worksheet], These instructions mainly (but not exclusively) apply to 2017 or earlier tax year returns. (form 2106) solved•by turbotax•2301•updated january 10, 2024.

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form 2106 Download Fillable PDF or Fill Online Employee Business, Thus, with respect to employee business expenses, a deduction under sec. Just to be clear, from 2018 through 2025, all employee moving expenses paid to employees by your business are taxable to the employee.

Source: wassmancpaservices.com

Source: wassmancpaservices.com

IRS Form 2106 Employee Business Expenses Wassman CPA Services LLC, Don't use business bank accounts for personal expenses. You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year, for carrying on your trade or business of being an employee, and ordinary.

Source: www.youtube.com

Source: www.youtube.com

IRS News Here’s who qualifies for the employee business expense, The tcja suspended the itemized deduction for miscellaneous deductions for tax preparation fees, unreimbursed employee business expenses, and investment. Specifically, the tcja suspended for 2018 through 2025 a large group of deductions lumped together in a category called miscellaneous itemized deductions that were.

Source: www.templateroller.com

Source: www.templateroller.com

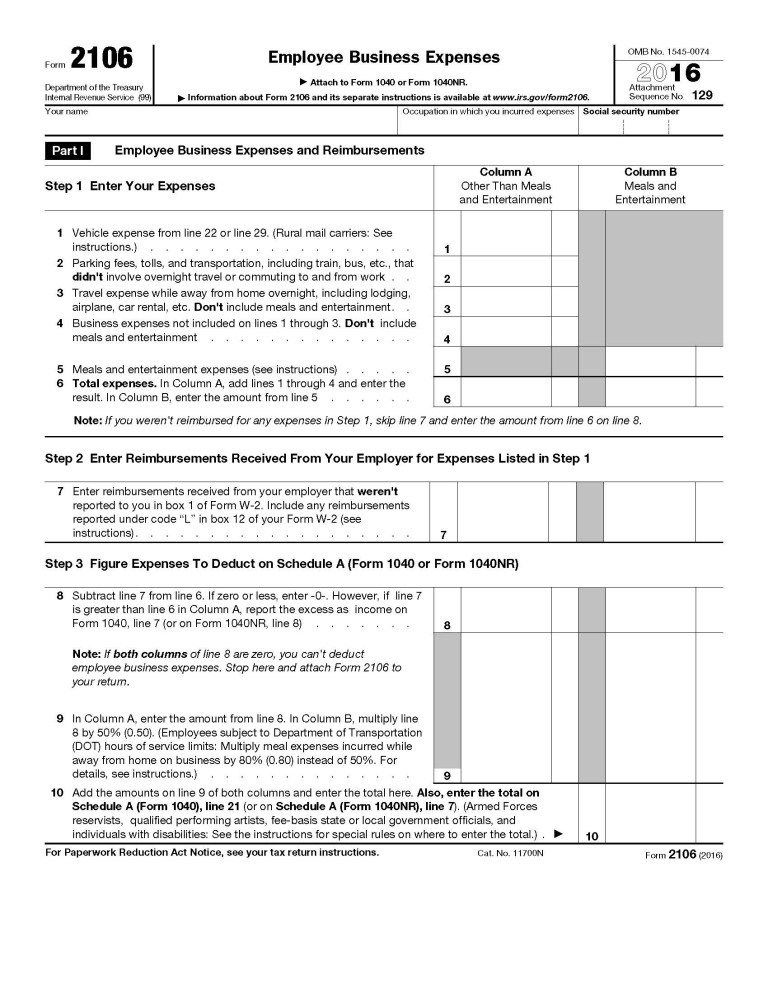

Download Instructions for IRS Form 2106 Employee Business Expenses PDF, These instructions mainly (but not exclusively) apply to 2017 or earlier tax year returns. The tcja eliminates the deduction for unreimbursed employee business expenses for tax years 2018 through 2025.

Source: www.dreamstime.com

Source: www.dreamstime.com

Form 2106 Employee Business Expenses Editorial Photo Image of form, Section references are to the internal revenue code unless otherwise noted. These instructions mainly (but not exclusively) apply to 2017 or earlier tax year returns.

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for IRS Form 2106 Employee Business Expenses PDF, You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year, for carrying on your trade or business of being an employee, and ordinary. Section references are to the internal revenue code unless otherwise noted.

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for IRS Form 2106 Employee Business Expenses PDF, Previously, miscellaneous expenses above 2 percent of agi, such as unreimbursed employee business expenses and income production expenses, were. Too many small business owners get so excited about running the business.

The Tcja Suspended The Itemized Deduction For Miscellaneous Deductions For Tax Preparation Fees, Unreimbursed Employee Business Expenses, And Investment.

Too many small business owners get so excited about running the business.

Previously, Miscellaneous Expenses Above 2 Percent Of Agi, Such As Unreimbursed Employee Business Expenses And Income Production Expenses, Were.

Section references are to the internal revenue code unless otherwise noted.